Growth catalyst for the lenders

Experience control with Synoriq LMS. Scale with confidence of compliance

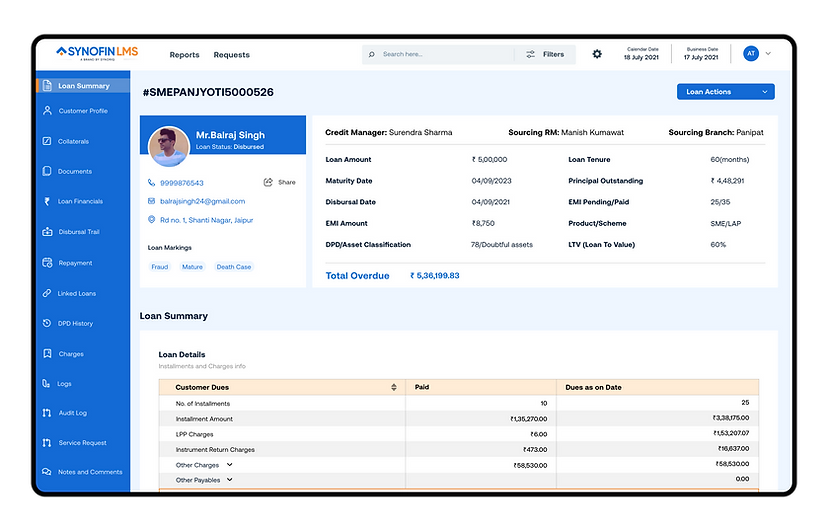

Glimpses of Synoriq LMS

Focus on innovation in customer acquisition – leave the boring loan management to us

New age lending trends

New age lending trends

- Co-lending/BC and securitization module

- FLDG and partner interest payouts

- Subvention

- Limit management – multiple loan products against single limit

- Structured repayment schedule

- BNPL / Supply Chain / Micro Lap / Gold Loans / Salary Advance / Dropline OD / Daily Installment

- API first

Operations

Operations

- System generated documents including Statement of Account, Foreclosure Letter, List of Documents

- NACH / PDC management

- 60+ Reports

- Management dashboards

- Automated CKYC reporting

- Configurability of appropriation sequence

- Ability to define a separate appropriation sequence on NPA

- Alerts to customers via SMS, Email and WhatsApp

- Bureau reporting

NPA management

NPA management

- DPD (Days Past Due) as per IRAC norms

- Auto classification on EOD to SMA-0, SMA-1, SMA-2, sub-standard, doubtful-1, doubtful-2, doubtful-3, Loss

- Auto movement of accrued interest to suspended interest

- Accounting write-off and write back of accounts

- Interest accrual in suspended

- Auto percolation of NPA status to linked accounts

- NPA upgradation only after all accounts are standard

Accounting

Accounting

- Voucher accounting – product / scheme / branch level

- GST, TDS and Invoicing handling

- IndAS compliant

- Accounting templates product / asset classification wise

- Automated accounting

Banking

Banking

- Automated disbursement through bank integrations

- Automatic EMI presentation and response update

- PDC / NACH handling

Controls

Controls

- Maker-checker

- Audit trails for all changes including backdated repayment schedule

- 2000+ validations

Synoriq LMS Highlights

Cost Efficient

Cost Efficient

With variable pricing based on book size. Synoriq LMS has been proven to be very cost effective with premium support

Automation

Automation

Synoriq LMS majorly focuses on automation in disbursement, Payment, Collection and much more

NPA Management

NPA Management

Auto classification on EOD to SMA-0, SMA-1 SMA-2, sub-standard, doubtful-1, doubtful-2, doubtful-3, Loss

Regulatory Compliance

Regulatory Compliance

Synoriq LMS is designed to ensure compliance with all the regulatory requirements and guidelines set by RBI

In-Built Co-Lending

In-Built Co-Lending

Synoriq LMS come with in-built co-lending capabilities with both CLM-1 and CLM-2 model supported

Extensive Coverage

Extensive Coverage

With more than 15+ Line Business Supported, Synoriq LMS built on a platform to support and configure any kind of Loan

Support 15+ Loan Products

Co-Lending

Synoriq LMS offers a comprehensive Co-Lending module that can be used with your existing legacy LMS.

This workshop will cover in-depth the day-to-day challenges faced by operations and accounts team.

Let’s Hear from our Customers

what they say about us

Compliance and Security as Core Focus

2FA Authentication

Rich access controls

Rich access controls

Why do all teams love us?

Relieve Your Team’s Burden – Our Support Ensures Smooth Sailing for All

What is so special about our

Loan Management Engine?

It’s the heart of any lending system

Why lenders are migrating to Synoriq LMS?

Embrace the new generation LMS Tech. Leave the migration to us

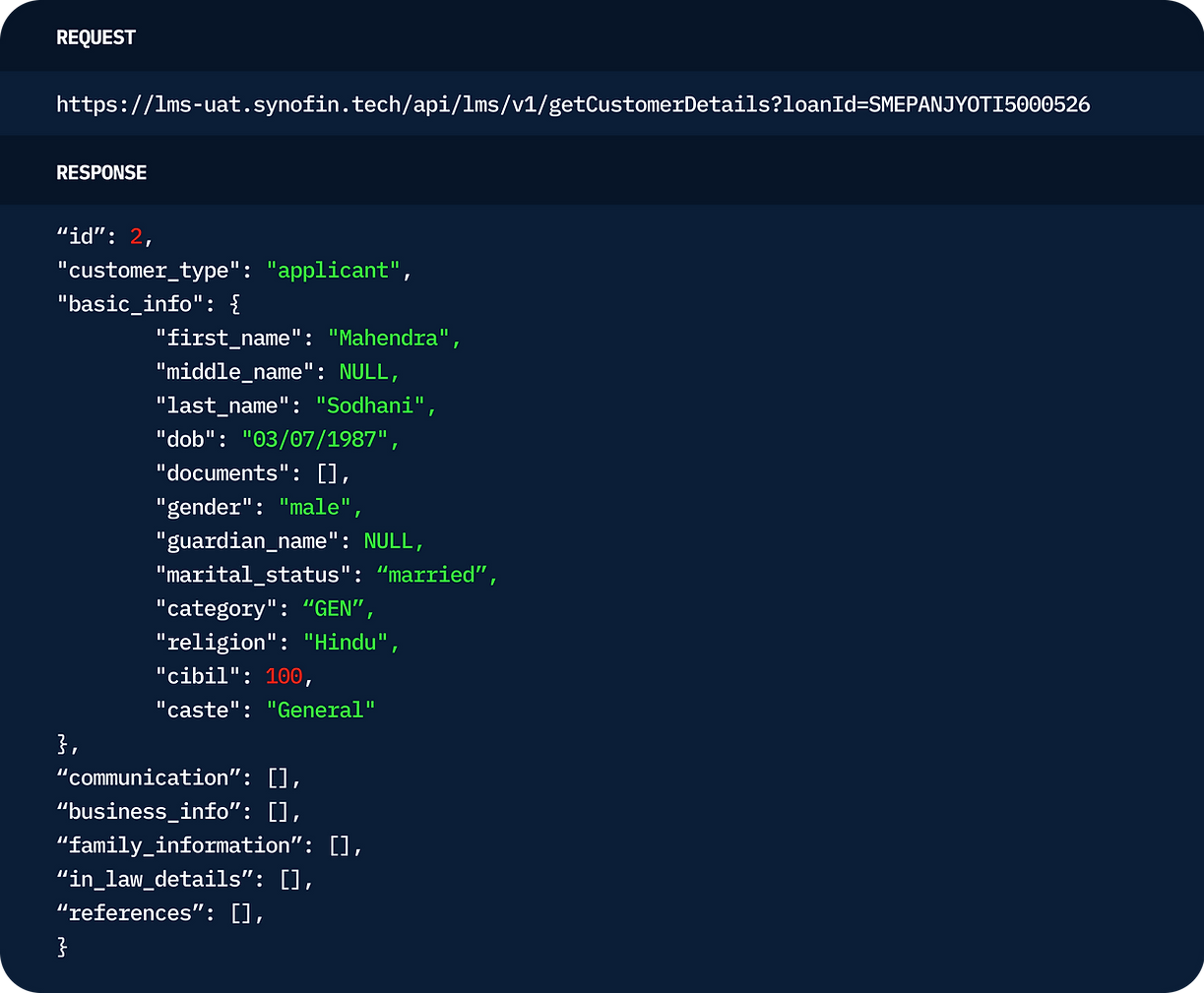

Open lending

stack

Use Synoriq applications or bring your own

peripheral application and connect through Synoriq API Box

Want to Check Our APIs

We have 100+ APIs with rich documentation.

Signup on https://docs.synofin.tech

Synoriq’s Thought Leadership

Demystifying RBI Fair Practice Code: A Practical Guide for “Interest Calculation from Actual Fund Disbursement Date”

On 29th April 2024, RBI released a notification on the Fair Practice Code for

How to manage co-lending operations with ease?

Your problem statement? Managing co-lending calculations very soon becomes difficult to handle through Excels.

Rising penetration of “Merchant Cash Advance” daily instalment loan offering

A merchant cash advance (MCA) was originally structured as a lump sum payment to